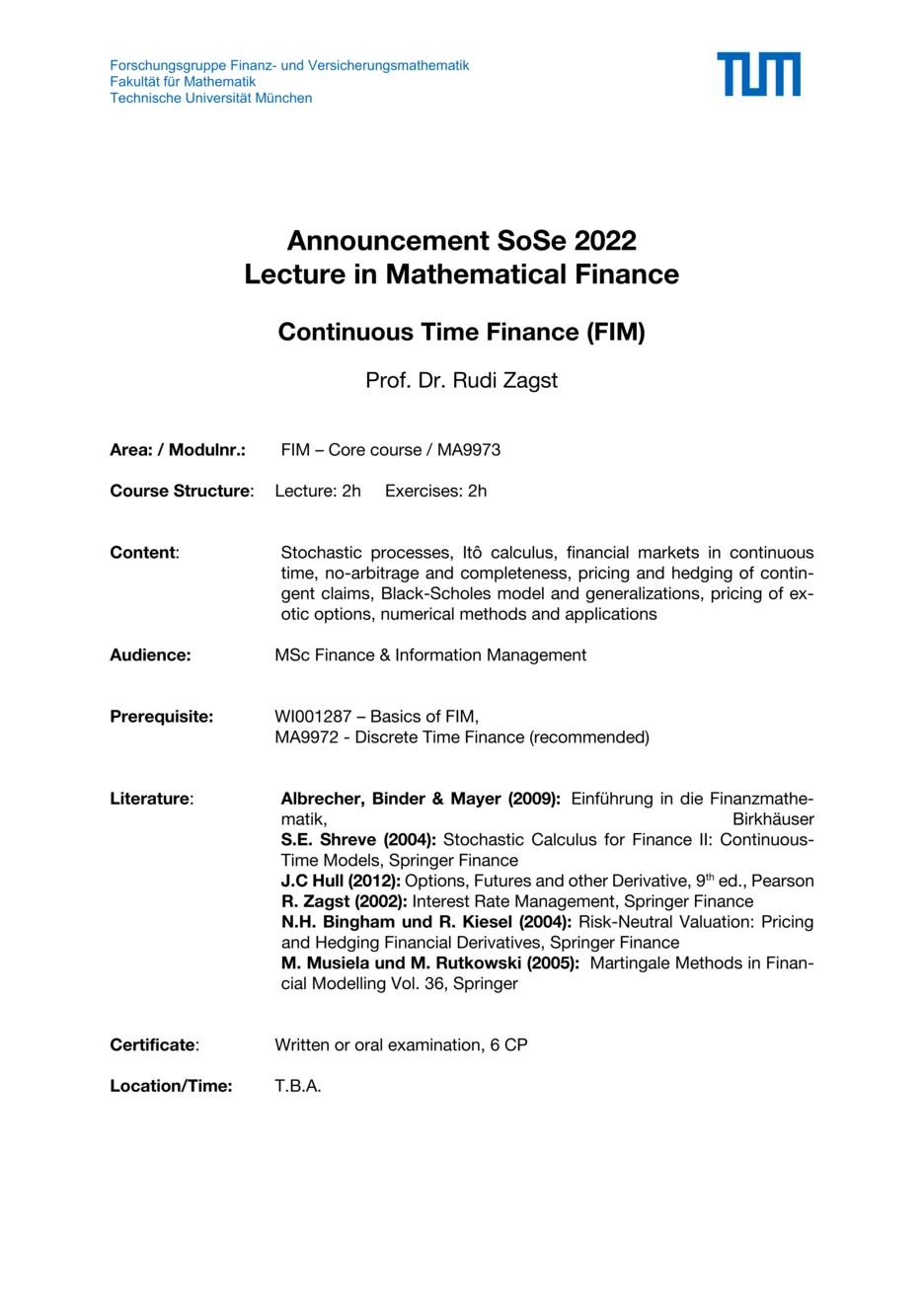

Continuous Time Finance (FIM) [MA9973]

| Lecturer (assistant) | |

|---|---|

| Number | 0000001892 |

| Type | lecture |

| Duration | 2 SWS |

| Term | Sommersemester 2022 |

| Language of instruction | English |

| Position within curricula | See TUMonline |

| Dates | See TUMonline |

- 25.04.2022 09:00-11:00 BC1 2.01.10, Seminarraum

- 25.04.2022 12:00-14:00 BC1 2.01.10, Seminarraum

- 26.04.2022 10:00-12:00 BC1 2.01.10, Seminarraum

- 03.05.2022 10:00-12:00 BC1 2.01.10, Seminarraum

- 11.05.2022 11:30-13:30 BC1 2.02.01, Seminarraum

- 09.06.2022 09:00-11:00 BC1 2.02.01, Seminarraum

- 09.06.2022 12:00-14:00 BC1 2.02.01, Seminarraum

- 09.06.2022 14:00-16:00 BC1 2.02.01, Seminarraum

- 13.06.2022 09:00-11:00 BC1 2.01.10, Seminarraum

- 13.06.2022 12:00-14:00 BC1 2.01.10, Seminarraum

Admission information

Objectives

Stochastic processes, Itô calculus, financial markets, arbitrage and completeness, pricing and hedging of contingent claims, Black-Scholes model and generalizations, pricing of exotic options, stochastic volatility and jump models, numerical methods (Monte Carlo simulation, Fourier pricing, etc.)

Description

After successful completion of the module, students are aware of the foundations of Itô-calculus and can apply mathematical theorems like the Girsanov, Lévy, and Radon-Nikodym theorems. They are able to understand the theoretical background of financial models in continuous time, including the notion of no-arbitrage, completeness, and the risk neutral valuation principle. Within the seminal model of Black and Scholes (and its generalization) for the description of stock prices, students are able to analyze financial markets for arbitrage opportunities and completeness; they are also able to price derivatives such as European options and to determine hedging strategies. Moreover, students know about more advanced modeling approaches, including their advantages and disadvantages, and understand the necessary numerical methods for working with these. Students are also able to implement numerical methods in a programming software like Matlab or R.

Links

Exercises

Exercises for Continuous Time Finance (FIM) [MA9973]

| Lecturer (assistant) | |

|---|---|

| Number | 0000001893 |

| Type | exercise |

| Duration | 2 SWS |

| Term | Sommersemester 2022 |

| Language of instruction | German |

| Position within curricula | See TUMonline |

| Dates | See TUMonline |

- 25.04.2022 14:30-16:00 BC1 2.01.11, Studentenarbeitsraum

- 26.04.2022 12:00-14:00 BC1 2.01.11, Studentenarbeitsraum

- 03.05.2022 12:00-14:00 BC1 2.01.11, Studentenarbeitsraum

- 11.05.2022 14:00-16:00 BC1 2.01.11, Studentenarbeitsraum

- 10.06.2022 10:00-16:00 BC1 2.01.10, Seminarraum

- 13.06.2022 14:00-16:00 BC1 2.02.11, Seminarraum

- 21.06.2022 10:00-16:00 BC1 2.01.11, Studentenarbeitsraum