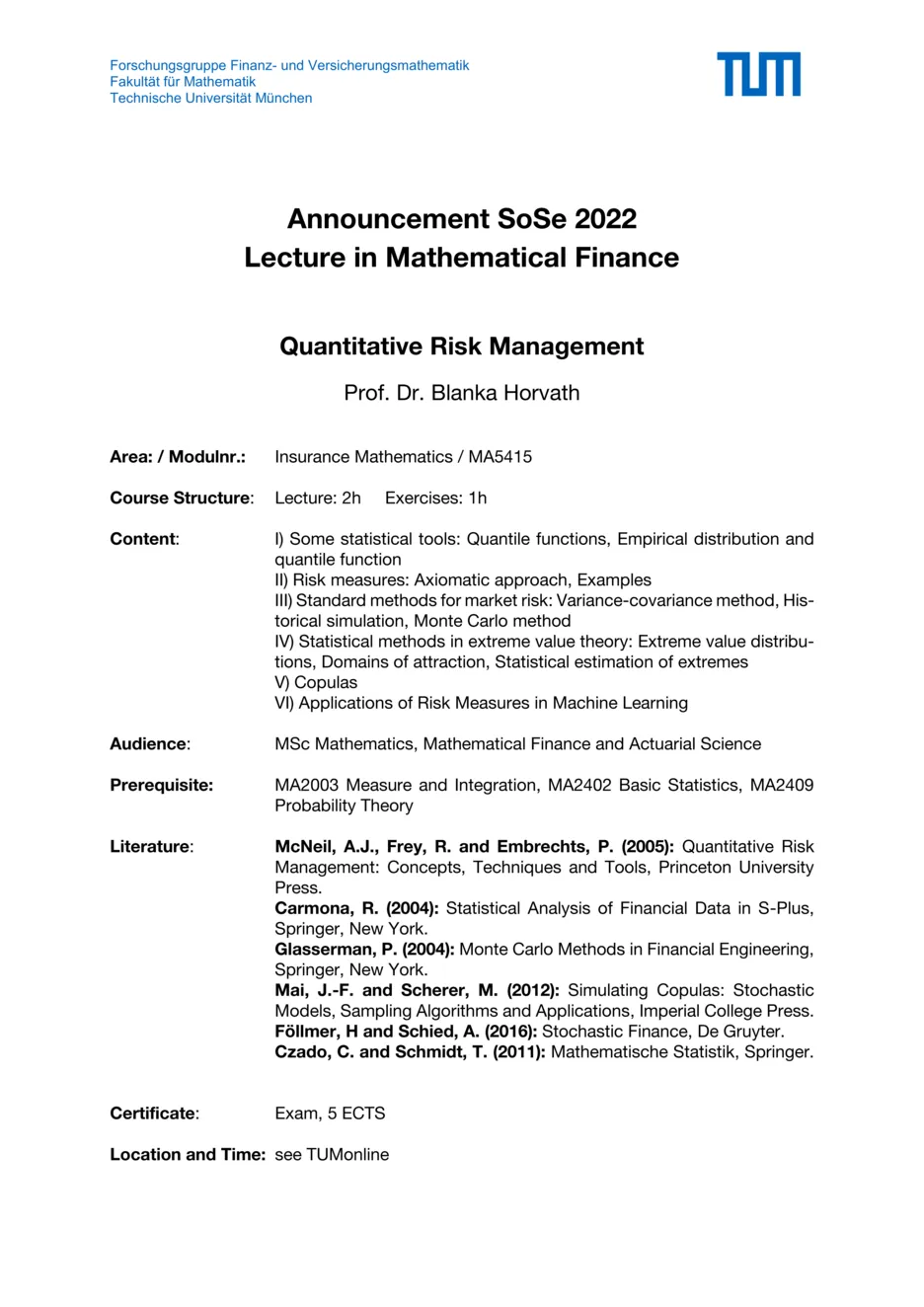

Quantitative Risk Management

| Lecturer (assistant) | |

|---|---|

| Number | 0000006068 |

| Type | lecture |

| Duration | 2 SWS |

| Term | Sommersemester 2022 |

| Language of instruction | English |

| Position within curricula | See TUMonline |

| Dates | See TUMonline |

- 26.04.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 26.04.2022 16:00-18:00 BC2 3.5.06, Hörsaal

- 27.04.2022 14:00-18:00 BC2 3.5.06, Hörsaal

- 28.04.2022 09:00-12:00 BC2 3.5.06, Hörsaal

- 28.04.2022 13:00-14:00 BC1 2.02.01, Seminarraum

- 28.04.2022 14:00-17:00 BC1 2.02.01, Seminarraum

- 29.04.2022 10:00-15:00 BC1 2.02.01, Seminarraum

- 03.05.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 10.05.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 17.05.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 24.05.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 31.05.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 14.06.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 21.06.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 28.06.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 05.07.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 12.07.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 19.07.2022 12:15-13:45 BC2 3.5.06, Hörsaal

- 26.07.2022 12:15-13:45 BC2 3.5.06, Hörsaal

Admission information

Objectives

At the end of the module students understand the basics of the trade of a financial risk manager. They know and understand the most important models and can apply methods used in the financial and insurance world to assess and evaluate risk. They are also able to do relevant data analyses and perform simple simulation studies. In particular, they are able to estimate VaR (Value at Risk) and Expected Shortfall (ES) in different realistic situations.

Description

Basic concepts in Risk Management,

Basel II and Solvency II,

risk measures: examples and discussions,

multivariate models: dependence modelling, normal and normal mixture models, copulas,

simple dimension reduction methods,

extreme value theory.

Basel II and Solvency II,

risk measures: examples and discussions,

multivariate models: dependence modelling, normal and normal mixture models, copulas,

simple dimension reduction methods,

extreme value theory.

Prerequisites

MA1401 Introduction to Probability Theory, MA2003 Measure and Integration, MA2402 Basic Statistics, MA2409 Probability Theory

Teaching and learning methods

Solve exercises, theoretical and practical (Matlab/R programming)

Examination

Final written exam

Recommended literature

McNeil, A.J., Frey, R. and Embrechts, P. (2005): Quantitative Risk Management: Concepts, Techniques and Tools, Princeton University Press.

Carmona, R. (2004): Statistical Analysis of Financial Data in S-Plus, Springer, New York.

Glasserman, P. (2004): Monte Carlo Methods in Financial Engineering, Springer, New York.

Carmona, R. (2004): Statistical Analysis of Financial Data in S-Plus, Springer, New York.

Glasserman, P. (2004): Monte Carlo Methods in Financial Engineering, Springer, New York.