Financial and Insurance mathematics offer access to complex processes in the financial world. A central element is the modelling of stocks and shares prices, interest instruments, raw materials prices, credits and actuarial risks. Only if these are understood, is it possible to evaluate options, quantify financial risks, value insurance policies and calculate optimal investment strategies.

The ability to choose suitable models for these processes is a particular challenge. They must on the one hand be flexible enough to realistically reflect the behavior of the modelled factors. On the other hand, the application should require a minimum of technical input, in order to make the process simple in its execution.

Research areas

Methodically, financial and insurance mathematics uses a wide repertoire of methods from stochastics, statistics, data science, economics, numerics, optimization, function theory and functional analysis. The main focus of our research groups lies in

- in interest rate structure modeling,

- the modeling and valuation of exotic options and complex credit derivatives,

- the valuation of insurance products,

- quantitative risk management

- the modeling of dependencies and

- dynamic portfolio optimization.

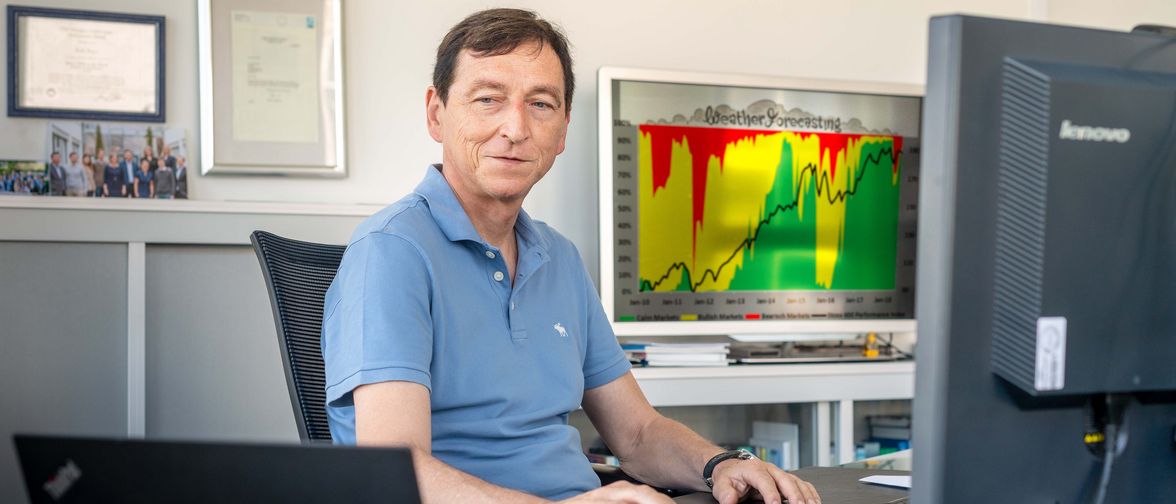

Our working group is very well-connected with the financial industry. Furthermore, we play a leading role in the Masters Degree Program "Mathematical Finance and Actuarial Science" as well as in the joint Elite Masters Program "Finance and Information Management" (FIM) at the TUM and the University of Bayreuth.

- Financial and Actuarial Mathematics

- Statistics